Digital transformation and the drive to deliver closer integration between online and off-line shopping was already a clear challenge for fast-moving consumer goods companies. But the unexpected crisis of 2020 has posed even greater difficulties, and companies are planning now how to adapt. It’s more important than ever to recognise how data, specifically mobility data, can guide business decisions.

Last year I spoke about the power that enterprises can unlock when they use data to drive efficiencies. The difficulties of 2020 have highlighted even more strongly the need and the opportunity to use mobility data, which is widely recognised as one of the richest sources of information because it is unbiased, plentiful, real time, and represents multiple market segments.

What’s changed since my last article is the urgency for enterprises – supermarkets and FMCG in particular – to seize every advantage as they adapt their strategy to address the economic impacts of lockdown restrictions and increased costs due to factors such as staff absences. When an enterprise operates in a fairly stable environment, it may not see the need to gather new insights. Everything has changed in 2020, however, and it’s important to recognise the unique value that data analytics can bring to an enterprise’s recovery plan, to help ensure it’s taking the right decisions during a critical time.

A changed market and transformed customers

One marked change is that, even in countries where online shopping has not been very popular to date, millions of customers have now been introduced to e-commerce. The permanent impact on shopping habits is not yet known, but it can be assumed that shoppers who have experienced the convenience of buying their weekly groceries online are likely to change their habits and use this channel going forward

Shoppers who have experienced the convenience of buying their weekly groceries online are likely to change their habits and use this channel going forward

This provides an opportunity for supermarkets who have mostly operated off-line to merge their online and real-world operations and data to deliver a more joined-up experience for customers. Connecting online and off-line data allows the enterprise to get a much clearer understanding of who their customers are, what product mix customers favour, and how customers move around in the real world.

Drawing on data from online and offline operations can also allow companies to set up or accelerate digital transformation initiatives like buy online, pick up in store (BOPIS). Such initiatives can have strong impacts on purchasing, as buyers need to cater for both foot traffic and demand from online shoppers.

The crisis of 2020 has also encouraged shoppers who are entering stores to use hand-held self-service scanners, or their mobile phones as scanners, which raises the requirement for supermarkets to ensure that in-store mobile connectivity is comprehensive and reliable.

Mobility data powering business decisions

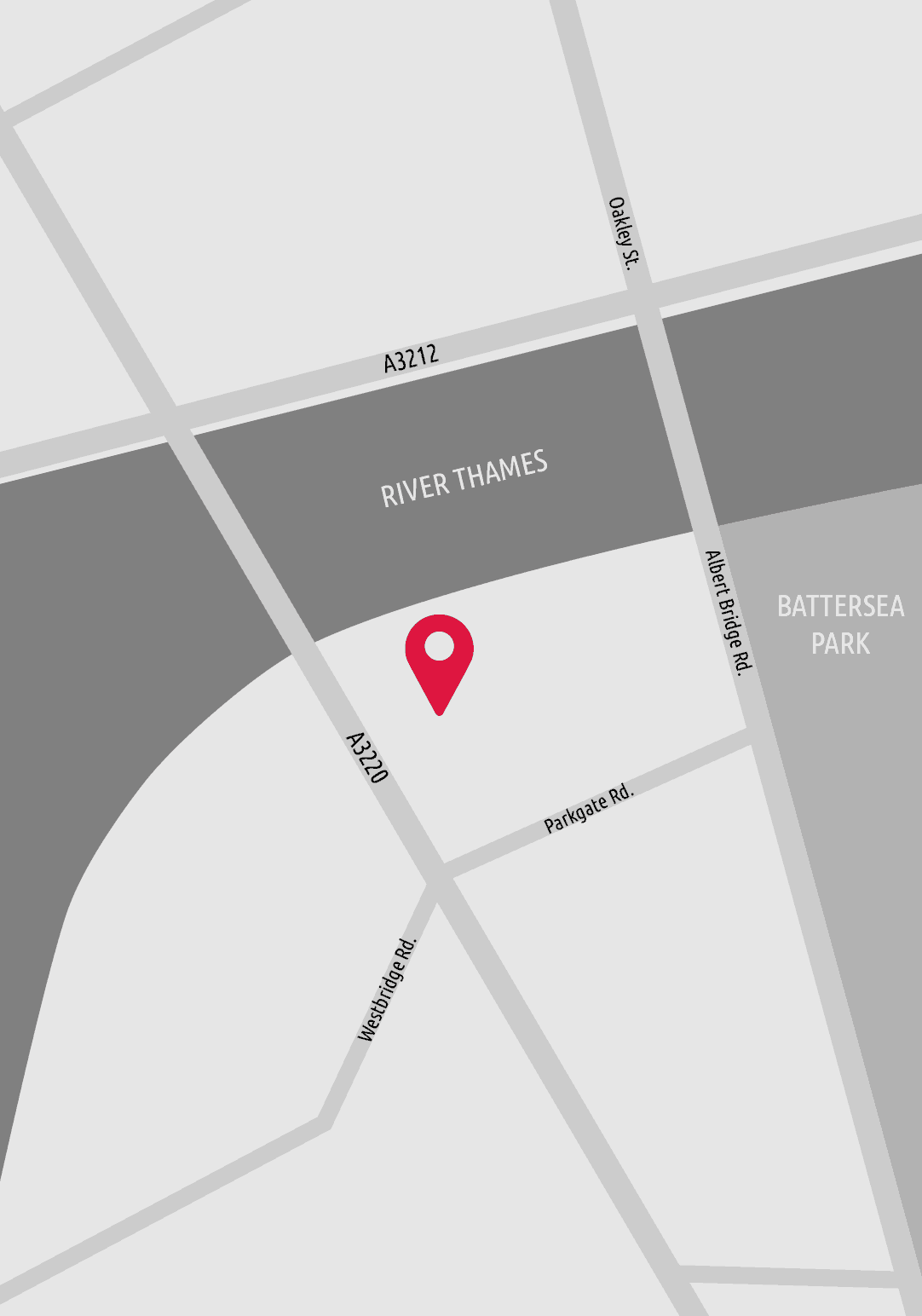

Enterprises can use mobility data – gathered anonymously and aggregated from user devices, in compliance with data privacy regulations – to understand how many people are entering their stores, what time of day, and how frequently they return. Merging that information with CRM data from mobile operators also allows the enterprise to get a wider view of that customer outside of the store – which parts of the city or country they come from, for example, and what age range and social segment they fall into.

That data can then be used to understand where, in the offline world, a supermarket needs to focus activities such as locating a new store or offering promotions for existing stores.

That data can then be used to understand where, in the offline world, a supermarket needs to focus activities such as locating a new store or offering promotions for existing stores.

In certain countries, companies may also be permitted to draw additional insights from the web usage of customers online, using data from digital profiles to develop a fuller picture of shoppers in order to target them with information and offers that are pertinent.

Competitive advantage at a critical time

Putting data at the centerpiece of enterprise strategic planning isn’t just a matter of competitive advantage, but of survival at this critical time. Supermarkets and FMCGs who have limited visibility on how many and what kind of shoppers are coming into locations, or who use older data that isn’t real-time, are in a weaker position during the recovery period than those who are capturing mobility data and joining it with other data sources to understand customers and how to best serve them.

Using data analytics strategically can accelerate recovery, facilitate closer integration between online and off-line operations, and deliver a more seamless customer experience for supermarkets and FMCG companies. It can also help ensure the enterprise makes the right investment decisions during a time when costs will be under closer scrutiny than ever.

Both online and off-line, shoppers and their mobile devices leave a trail of data that is packed with insights and can provide tremendous benefit to the enterprises who know how to unlock its value.